Cohabitation is one of those legal terms that makes its way around law firms but means very little to a lot of people. Essentially, cohabitation just means living together without being married and more and more couples are choosing to do this.

With religion playing a smaller role in many people’s lives, the average cost of weddings standing at a staggering £18,400, and the prevalence of Tinder, Bumble and Hinge changing people’s dating habits, marriage has never been less popular.

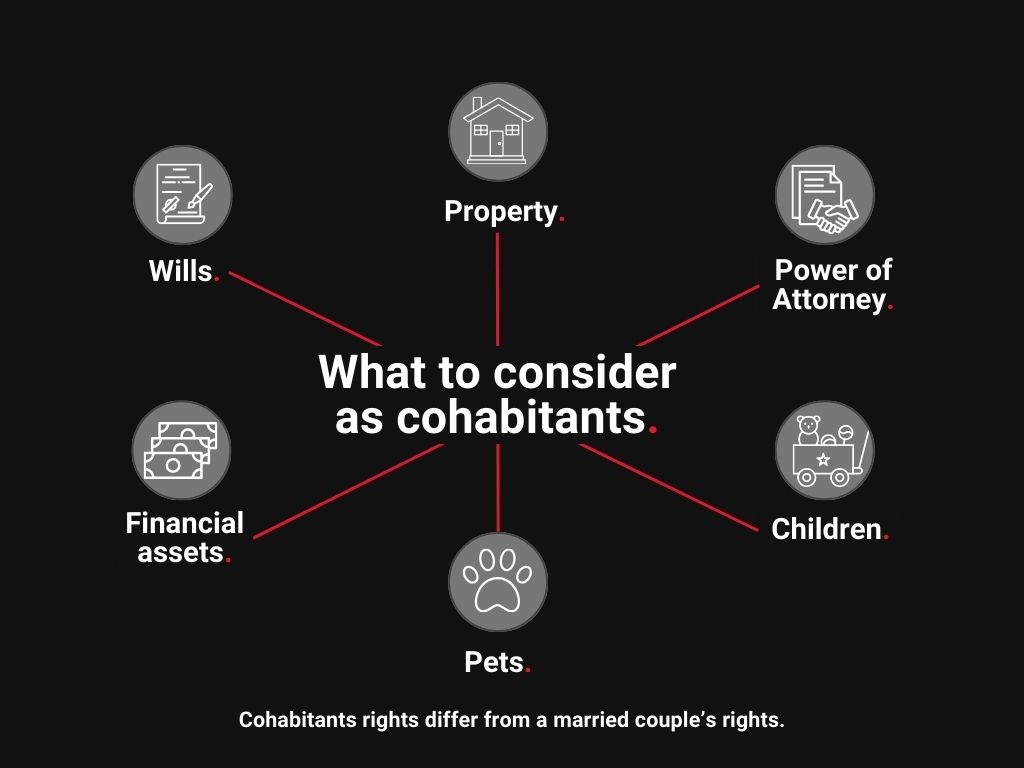

As a family law expert, I’ve written this guide to cohabitation so that couples can understand what it means to be cohabitants, how it affects their rights, and potential procedures that can solidify their future arrangements.

Most read articles related to cohabitation

What happens when unmarried couples split

Unmarried couple’s rights

Cohabitation agreements

Occupation orders

What is cohabitation?

After the sexual revolution in the 60s, the concept of marriage began to lose popularity as society became more liberal. Increasingly, couples were choosing to live together unmarried as a personal choice.

Fast forward to 2023 and almost a quarter of all couples are living together unmarried. And that is exactly what the term cohabitation means.

These days, cohabiting couples can include those living:

- In a rented property

- In a property they’ve purchased together

- With a child/children

- As a same-sex couple

- As an opposite-sex couple

But why is this important?

Unlike married couples, cohabiting couples were historically persecuted. Given the age of many of our legal system in England and Wales, the law isn’t always in alignment with modern society.

This leaves many couples unsure of where they stand when it comes to their rights, which can cause significant problems upon separation or death.

Why do people choose to cohabit?

There’s a popular belief that cohabiting couples are either gay/lesbian or young and yet to marry. While this is partially true, cohabitation rates are increasing across the board, including in the over 60s.

Many couples choose cohabitation over marriage because they:

- Don’t believe in marriage

- Want to spend their money on something else

- Have already married and are divorced or separated

- Fear the finality marriage brings and the fallout of divorce

There are positives and negatives to choosing cohabitation, especially if you aren’t interested in marriage or civil partnership.

| Pros | Cons |

|---|---|

|

|

The Cohabitation Experts

Need guidance or legal advice surrounding your cohabitation arrangements? Our expert team can:

- Help you understand your rights as a cohabitee

- Handle cohabitation agreements

- Set up wills or Power of Attorney

Cohabitation rights

As with many things in life, the good always comes with the bad and cohabiting is no different.

While cohabitation offers much more flexibility in your relationship, particularly if you separate, you and your partner also have fewer rights. That’s not to say that either option is better, but it’s important to understand both situations.

Common law marriages - myth or reality?

Common law marriage (or a ‘de facto relationship’) is a term that’s often used to describe cohabiting couples. Many believe the term grants cohabiting couples the same rights as married couples.

While this is the case in some countries, common law marriage doesn’t exist in England and Wales and unmarried couples have little to no rights.

Everyone has heard of divorce, and most people are aware that after divorce, you typically walk away with a ‘divorce payout’.

But no such guarantee exists for cohabiting couples.

In fact, in many cases, one person in the couple can leave the relationship with nothing. This is why it’s so important to understand where you stand.

Cohabitation and your home

Whether you’re buying or renting a property together, you and your partner’s rights vary – and sometimes significantly.

We’ve broken down the most common living arrangements below, alongside the legal aspects to bear in mind.

Renting

Renting comes without the extra complication of a mortgage, but you may have a joint tenancy instead. This means you’re both equally responsible for paying the rent – whether you’re together or not.

There’s also the matter of fairly managing and separating your belongings.

Buying a property together

Couples buying a home together typically apply for a joint mortgage, meaning you both have equal legal ownership. This is known as being joint tenants and is most common in both marriage and cohabitation.

As joint tenants, if you separate, then ownership of the property remains 50/50, regardless of your relationship. Importantly, it also means that you must make any decisions about the property together. One person cannot simply choose to sell the property or their half of the property.

You can also purchase a property as tenants in common where each person owns a share of the property. This is most often a 50/50 split, but it doesn’t have to be. Some couples may split ownership depending on deposit contribution or earning capacity.

And unlike joint tenants, tenants in common can sell their stake of the property independently of the other person, which can offer more flexibility if your relationship ends.

Moving in together

If one of you already owns a property, you may decide you want to live together in that property. Cohabitation doesn’t create any legal rights to property in and of itself, but what happens during the relationship and upon separation can.

If the person who doesn’t own a part of the property moves in and helps to pay the mortgage, or for maintenance works or improvements, this can create what’s known as a beneficial interest.

This is essentially an implied ownership of some proportion of the property. However, whether this stands true may require a court’s decision in the form of a TOLATA claim.

Looking to set up a cohabitation agreement?

Whether it’s advice, planning or just a simple question, speak to our family law team to get started.

Cohabitation and your family

Gone are the times when couples were hauled over the coals for having children out of wedlock. Nowadays, unmarried parents have almost identical rights to married couples when having children. This is because the law protects a child’s best interests rather than those of the parents.

What this means is that neither of you can simply walk away from your responsibilities both as parents and financially to the children.

Equally, if you cannot agree on your approach to child custody, you’ll need to apply for a Child Arrangement Order through the Family Court.

There are also other scenarios that can affect your living arrangements. These include children from other marriages or caring responsibilities for other family members.

What happens to the family pet if we separate?

Even if you love your pet like a child, in the eyes of the law a pet is an inanimate object and, unlike children, they don’t have any rights.

The easiest way to look at the ownership of a pet is the same way as looking at a property. If you can prove you purchased the pet, paid for its care and you’re named on its microchip then it’s likely you could prove you’re its legal owner.

Cohabitation and inheritance

Many people put off writing their wills, but they are crucial documents if you don’t intend on marrying.

This is because marriage gives couples automatic rights to each other’s estates if either of you passes away without a will. This is a significant difference to cohabitation where, in the same situation, the surviving partner gets nothing.

Instead, in a cohabitation relationship where you’re the person who passes away first, intestacy rules will govern your estate. This means that any children you have, including children from other relationships, would inherit first, followed by your parents and so on.

At no point would your partner receive any inheritance under the intestacy rules. This is why it’s vital to create a will if you don’t plan on getting married.

You should also ensure you’ve covered other financial matters, such as your bank accounts, pension, life insurance and investments. Banks and financial institutions often won’t grant access to surviving unmarried partners unless you had a joint account.

Living together but worried about your rights outside of marriage?

Lines open 24/7

Cohabitation agreements

A cohabitation agreement or living together agreement is a legal document that sets out your assets, financial obligations, and other responsibilities.

In some ways, they’re like separation agreements or pre-nuptial agreements in that both sides agree on a fair way to part ways.

As with those different agreements, it’s also important to regularly update your cohabitation agreement. Failing to do so may mean your agreement becomes invalid over time as it no longer reflects your current relationship and possessions.

On the whole, cohabitation agreements are a great way to set expectations with your partner and prepare for all eventualities.

What do cohabitation agreements cover?

Cohabitation agreements can cover many topics, including:

- Property-related matters (owning or renting) and equity splits

- How you’ll split bills

- Bank accounts

- Financial affairs such as pensions, life insurance, debts

- Asset management

- Child arrangements

- Business and share ownership

- Pets

Each cohabitation agreement is tailored to suit your unique needs as a couple so these topics will vary.

Cohabitation: the verdict

Cohabitation is an increasingly popular arrangement for couples. It gives people the opportunity to live together and grow their relationship, without the costs of a wedding.

Cohabiting couples don’t have the same rights as married couples, so it’s best to prepare legal documentation.

Together, a cohabitation agreement and will can help you mitigate stress down the line.

Our family law team can help you straighten out your affairs and ensure that you’re covered in all eventualities.