If someone passes away without a valid will, it’s easy to panic about who gets what assets. However, it’s surprisingly common for someone to pass away without a valid will as a recent study in the UK highlights that 37% of people over 55 don’t have a will. As a result, if a will doesn’t exist, there is a set of rules in place to distribute someone’s estate. This set of rules is known as the ‘intestacy rules’.

If you have any questions regarding the intestacy rules, please visit our wills and probate page for more information or contact our solicitors directly on 0203 007 5500.

What is intestacy?

In short, intestacy is when someone dies without having a valid will. In this circumstance, questions can arise amongst friends and family members regarding the estate’s contents.

A will can be invalid for several reasons, which include:

- The deceased never making a will.

- If the will wasn’t made in accordance with the Wills Act 1837, for example, if the will hasn’t been properly signed and witnessed.

- The deceased intentionally revoked the will, for instance, if they deliberately destroyed the will.

- Whether the deceased unintentionally revoked the will, for example, when someone enters into a marriage or civil partnership without updating there will.

Intestacy can be total or partial. A total intestacy occurs when someone dies without leaving a valid will. A partial intestacy is where there is a will and only certain assets in the estate follow the intestacy rules.

What are the rules of intestacy?

When someone passes away without a will, any unaccounted assets are distributed following specific rules. These rules are known as the ‘intestacy rules’. Under the intestacy rules, the estate can only be inherited by your spouse, civil partner and a few other relatives.

Under the intestacy rules, assets may end up passing to distant relatives who were not even aware of the deceased’s existence.

Who inherits under intestacy?

When it comes to inheriting, if there’s no will, and the deceased died, leaving a spouse or civil partner, and there are surviving children, the estate will be distributed as follows:

- All personal belongings are given to the spouse or civil partner.

- The spouse or civil partner receives the value of £250,000 from the estate, free of inheritance tax, plus interest. This sum can be received as cash or by way of value in estate assets such as the deceased’s home.

- The remainder of the estate after the £250,000 reduction is split into two halves. One half is left to the spouse, civil partner, and the other half goes to the deceased’s surviving children.

However, in circumstances where someone passes away without leaving a surviving spouse or civil partner (or the spouse or civil partner dies within 28 days of the deceased), then the residuary estate passes to their blood relatives in a legally prescribed order of priority, as follows:

- Children (if more than one then in equal shares);

- Parents (equally, if both alive);

- Whole blood brothers and sisters;

- Half-brothers and sisters;

- Grandparents (equally, if more than one is alive);

- Uncles and aunts; and

- Half-uncles and aunts.

If the deceased leaves no blood relation, then the deceased will leave their entire estate to the Crown.

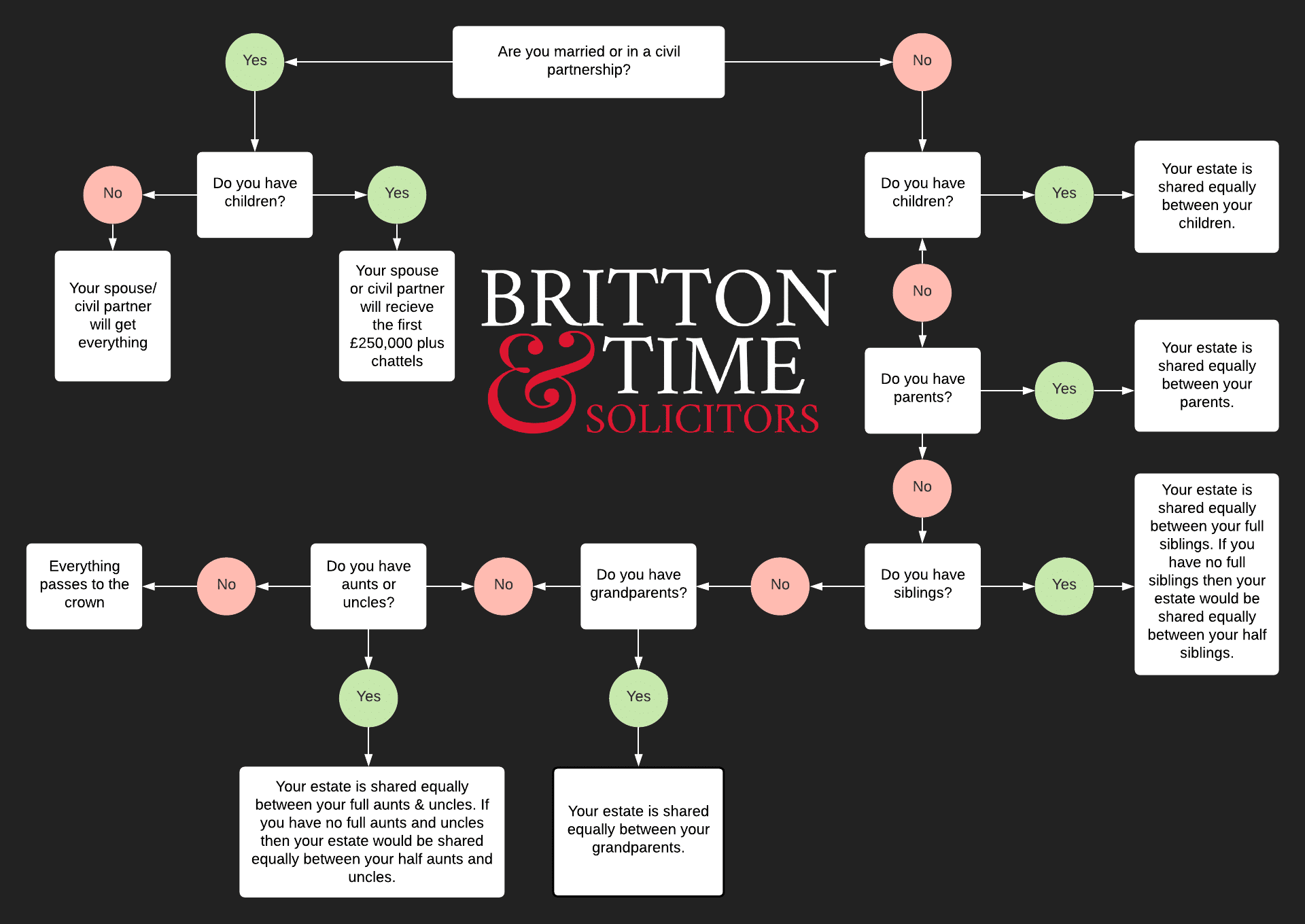

Intestacy rules flowchart:

Who can’t inherit under intestacy rules?

Unfortunately, the following people have no right to inherit where someone dies without leaving a will:

- Unmarried partners

- Same-sex partners who are not in a civil partnership

- Relations by marriage

- Close friends

- Carers

- Former partner (for example, if a couple has a legally recognised decree absolute, which confirms the end of your marriage).

What assets do intestacy rules apply to?

Even when there is no will, not all of the deceased’s property will necessarily be affected by the rules. Some examples of assets that aren’t impacted by the intestacy rules are as follows:

- Assets held jointly with someone else, such as a joint bank account, will not be affected by the intestacy rules. In this circumstance, the joint account holders will automatically own the entire account.

- Any assets which are in a trust, where the deceased was one beneficiary.

- Proceeds of a life insurance policy that have been declared to benefit another individual.

- Assets that don’t fall under the jurisdiction of England and Wales. In this instance, the rules in that jurisdiction would apply.

What is partial intestacy?

Partial intestacy occurs when someone dies, leaving a valid will, but the will doesn’t account for their entire estate. In this circumstance, the intestacy rules only apply only to the assets that the will fails to include.

Partial intestacy commonly occurs when a will isn’t properly drafted and reviewed by a specialist solicitor. When a solicitor drafts a will, they will account for such factors to avoid partial intestacy. For instance, a solicitor will include ‘catch all’ provisions to account for other assets and gifts that may fail. A gift can fail when a beneficiary predeceases them. Therefore, including a ‘catch all’ clause will provide an alternative beneficiary in such a situation.

Partial intestacy is also expensive and time-consuming, as an executor will need to carry out tasks, such as consulting a genealogist to identify distant relatives of the deceased’s family.

Can intestacy be challenged?

The intestacy rules are complicated to challenge. However, there are a few instances when someone can claim to set aside an intestacy’s provisions. Two examples of which are:

- One such circumstance is when someone is entitled to claim against the estate under the Inheritance (Provision for Family and Dependents) Act 1975. Such a claim can be brought by anyone dependent on the deceased. After application of the intestacy rules, no reasonable financial provision was made for them.

- The other circumstance is when a beneficiary under the intestacy rules can give up their right to benefit by agreement as a beneficiary under a will. Depending on the circumstances, various other individuals entitled to benefit under the intestacy may also need to agree.

What should I do if I can’t find someone’s will?

Several avenues should be explored when you think someone left a will, but you cannot find their will. Before making any assumptions, the first step is to enquire with the deceased solicitor (if they had one) and conduct a thorough search of their house.

In a scenario where you still cannot find a will, it’s beneficial to reach out to a probate solicitor to help you locate the will. A probate solicitor will notice in the Law Society Gazette, search commercial wills registers, and search the probate registry local to the deceased.

Leave a comment Your email address will not be published.