As a construction professional, you’ve likely faced the frustrating situation of a customer not paying their invoice. This common issue can severely impact your cash flow and project timelines – both important factors that a construction project relies on.

It’s concerning to know that in 2022, 87% of SMEs reported that their invoices were paid after the due date. So, it’s no surprise there’s a lot of volatility in the construction industry and a breakdown of trust between contractors and customers.

But what can you do about this age-old problem? In this guide, I walk you through the steps to take when a customer refuses to pay for completed work and provide strategies to protect yourself in future projects.

Looking to cut to the chase? If you need a solicitor to help you resolve your construction dispute, just call us on 0203 007 5500, or submit a contact form.

Understanding why customers don’t pay invoices

Before exploring solutions, it’s crucial to understand why customers might delay or refuse payment.

Common reasons include:

- Simple forgetfulness

- Waiting for payday or fund releases

- Dissatisfaction with the work

- Incomplete work (or perception thereof)

- Financial difficulties

- Disagreements over pricing

- Set company payment dates (e.g., the 30th of each month)

Once you understand why your customer isn’t paying their invoice, you can tailor your approach.

How do people end up owing money to contractors?

Every company has its own payment processing system, and processes may change depending on the work required. Contractors rarely ask for payment in advance of completing the work. This practice alone fuels the problem.

Typical payment arrangements are:

- A deposit upfront, full payment upon completion

- Upfront payment for parts and materials, outstanding payment upon completion

- Agreeing on a price before the job, paying it upon completion

- The customer buys the parts and materials and pays the contractor upon completion

- Payments by way of an agreed schedule or instalments

How unpaid invoices affect people and their businesses

Unpaid invoices can have severe consequences for construction businesses, including:

- Cash flow disruptions

- Difficulty paying suppliers and subcontractors

- Inability to take on new projects

- Stress and strain on personal finances

- Potential legal costs for debt recovery

With such a high number of people paying their invoices late, contractors and businesses are often juggling more than one late payment. This can easily add up to a substantial amount, particularly affecting sole traders who rely on these funds to keep their business functioning and food on the table.

What can you do when a customer isn’t paying their invoice?

Review the contract

Start by thoroughly examining the contract you have with the customer. Ensure you’ve met all your obligations, and that the payment request aligns with the contract terms. Check for:

- Payment milestones or scheduled stages

- Required format and content for payment requests

- Correct delivery method and recipient for invoices

If you’re unsure about any contract terms, consult a solicitor specialising in construction law.

Construction contracts usually specify the price, dates of payment, and terms of payment. Disputes are much trickier to navigate and resolve if you don’t have a construction contract including this information.

Communicate with the customer

Open a line of communication with the customer to understand why they are withholding payment.

There may be a legitimate reason that you can address such as they forgot, they are waiting for payday, or they feel that part of the work needs amending.

Clear communication can often resolve issues without the need for further escalation.

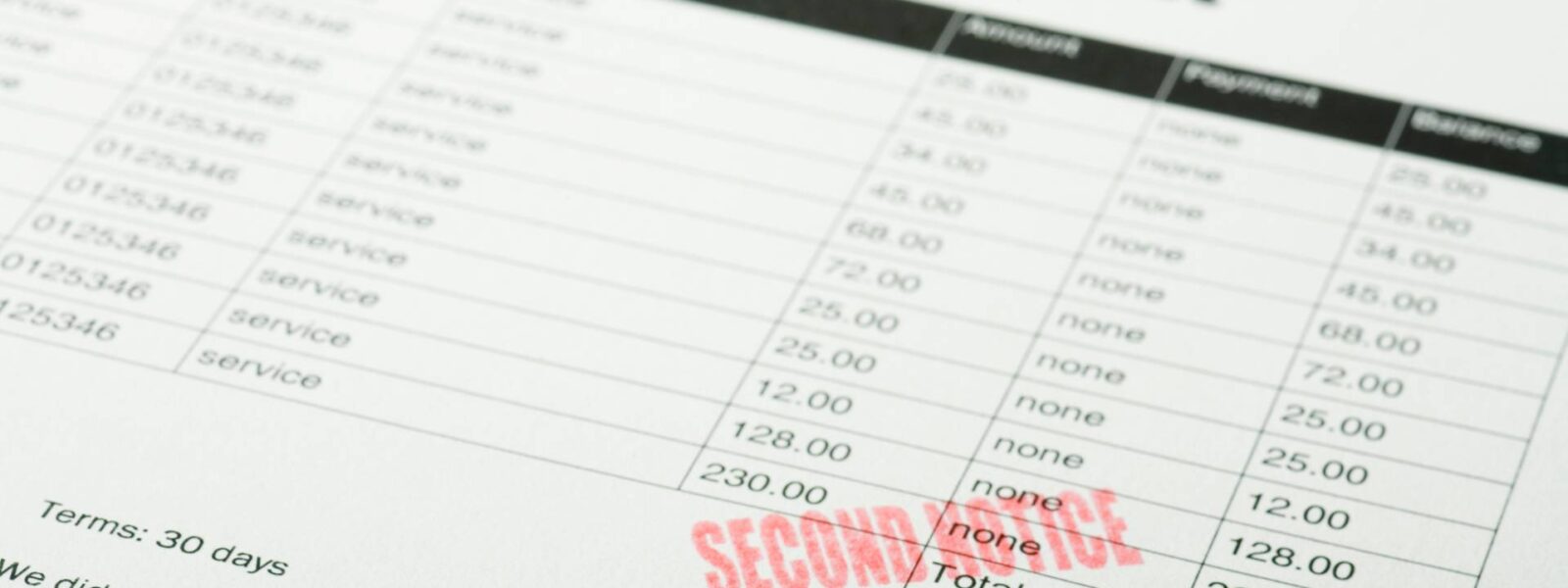

Send a formal payment reminder

If initial communication doesn’t yield results, send a formal payment reminder. Include:

- A detailed description of the completed work

- The amount due

- Relevant contract terms

- The due date

- Any applicable late payment interest

- A clear statement of intent to take legal action if payment isn’t received by a specified date

If you want to go down the road of formal debt collection, you can send a Letter Before Action. You can read more about debt collection methods and Letters Before Action in our blog.

Alternative dispute resolution

Your contract will specify which dispute resolution method all parties agree to, so refer back to this.

All parties to a construction contract have the right to adjudication before court litigation. Adjudication is where a neutral party makes an interim binding decision before a court judgment. This kind of dispute resolution can be effective in circumstances where there’s a disagreement about quality or the pricing of work.

In many cases, mediation or arbitration is the quickest and most cost-effective solution.

Mediation allows both parties to explain their side of the story and a third party will help them reach a mutual agreement.

Arbitration involves a neutral professional with expertise in the field of the dispute. They will make an out-of-court but legally binding agreement.

Legal action

If all other efforts fail, you may need to take legal action. This could involve:

- Pre-action protocols

- Filing a claim in Small Claims Court for smaller amounts (below £10,000)

- Pursuing formal legal proceedings for larger sums (above £10,000)

Once a case is issued, the only way the proceedings can be resolved before trial is if the parties agree to a settlement or one party files a notice of withdrawal.

If you change your mind and file the withdrawal, the court could order you to pay some or all of the other party’s legal costs.

At this stage, it’s highly advisable to seek legal advice if you haven’t already. A construction solicitor will help you understand your position and the potential risks.

What are pre-action protocols?

Pre-action protocols are mandatory preparation and actions that each party must follow before pursuing a court hearing. The court could impose sanctions if you fail to follow pre-action protocols.

In some circumstances, parties come to an agreement during their pre-action protocols and will choose to settle.

Your matter will escalate to court if you don’t resolve the dispute during pre-action protocols.

How to protect your business income from customers not paying invoices

With the nature of invoicing, it’s normal for some delays to occur. But there are some practical tips that can help you minimise delays and disruptions to your income.

- Use stage payments: Require payments at specific project milestones before work continues.

- Include the right to suspend work: Add a clause into your contract allowing you to halt work if payments aren’t made as agreed.

- Clearly define payment terms: Specify due dates, late payment penalties, and accepted payment methods.

- Perform credit checks: Assess the financial stability of potential clients before agreeing to large projects.

- Require deposits: Ask for a portion of the payment upfront, especially for materials and initial labour costs.

- Maintain a good rapport with customers: By communicating effectively and building trust, you will likely minimise the risk of non-payment.

- Send regular reminders: Set up payment reminders to go out by text or email to remind customers. You could also print off letters to leave at the client’s address if that works better for them.

- Keep track of documents and communications: Ensure you have a good filing system to store all your documents for a job. Being able to access paperwork easily allows you to refer to agreements and contractual rights.

A robust contract includes many of these tips, which is why I always recommend ensuring that you have one for each job.

Dealing with a customer not paying their invoice can be challenging. By following these steps and seeking legal advice, you can protect your business and improve your chances of receiving payment.

Prevention is key – implementing strong contract terms and payment practices can help you avoid payment issues in the future.

If you’re facing a non-payment situation or want to review your contracts to better protect your construction business, don’t hesitate to contact our construction law team at Britton and Time. We’re here to help you navigate these challenges and ensure you get paid.

Leave a comment Your email address will not be published.