You may not feel that fussed about getting married or would rather save the money you’d spend on a wedding and spend it on something else like a house, car, or holidays. But have you thought about the financial benefits of marriage?

The average cost of a UK wedding is around £18,000 which is enough to put people off entirely. This can feel especially out of reach when you factor in the cost-of-living crisis, rising energy bills, and high inflation.

Marriage and civil partnership can be achieved for a much lower price tag and may come with longer-term benefits. Depending on your plans and preferences, you might find that marriage is more financially beneficial to you.

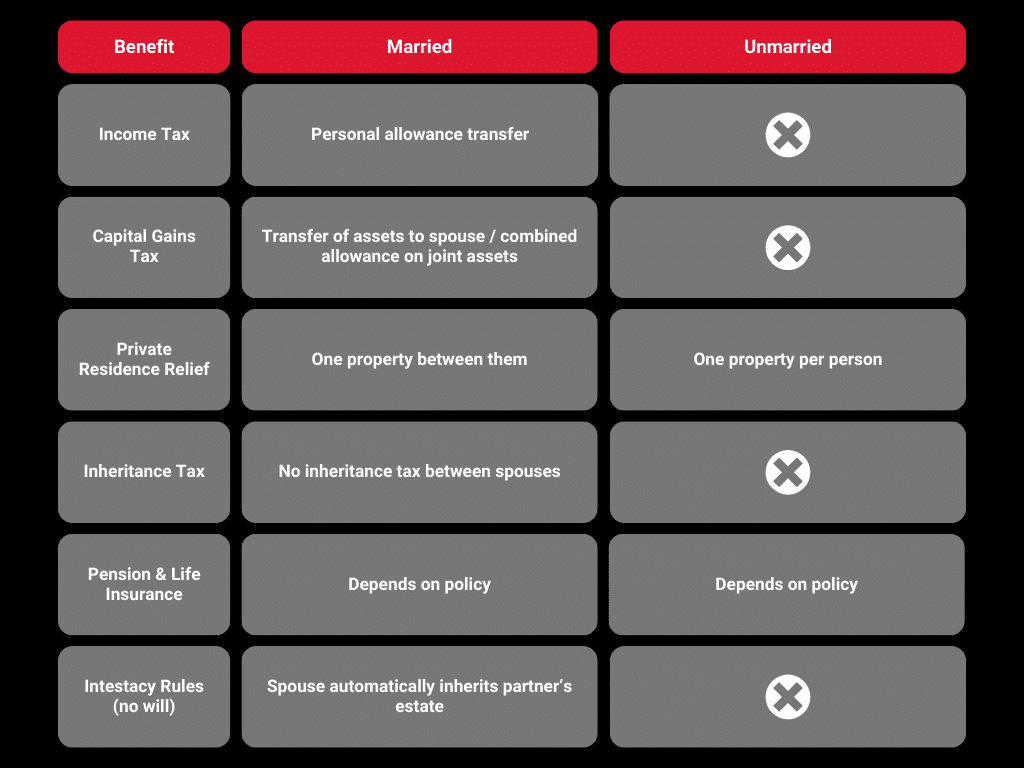

Married couples or those in a civil partnership receive certain benefits in relation to income tax, capital gains tax, and inheritance tax.

In this blog we explore the question – does it pay to get married? If you’re on the fence about marriage due to financial reasons, this one is for you…

If you have any questions about taxes or need financial advice, seek a regulated financial advisor.

Income tax

Income tax applies to any income you earn. Your income can be from your job, self-employment profits, homes you rent out, and pensions. Any income that exceeds the threshold of £12,500 is subject to income tax.

For unmarried couples, your income is taxed separately, regardless of how long you’ve been together or if you live together.

Married couples do receive some income tax benefits. As long as neither of you is in the higher taxpayer band and one person has a low income, they can transfer 10% of their personal allowance to their partner, reducing their tax by up to £252 in the tax year (6 April to 5 April of the next year). This is commonly known as “Marriage Allowance”.

Example: Partner A earns £10,000, meaning they pay no tax as the income tax threshold is £12,500. Partner B earns £40,000 (below the higher tax band for income over £50,000). Partner A transfers £1250 of their allowance to Partner B, saving them £250 a year.

Married couples can give each other monetary gifts tax-free as these don’t count as income.

Capital gains tax

Capital gains tax is applicable to any profit made when you ‘dispose’ of an asset that has increased in value. Disposing of an asset can include selling, transferring, gift giving, swapping, and insurance payouts.

Unmarried couples benefit from ‘private residence relief’, also known as ‘principal property relief’. This is a tax relief for individuals who sell their main residence and removes the capital gains tax paid on the sale.

This means that each person can individually own and sell their property. There are criteria to meet, so make sure you research this or speak to a financial advisor.

There are financial benefits of marriage for the purpose of capital gains tax. Married couples are automatically classed as living together, so they can only benefit from private residence relief on one property.

As a married couple, you can combine your capital gains tax allowance for all joint assets, increasing the tax threshold. You can also transfer part of your assets to your spouse to benefit from their capital gains tax allowance.

Inheritance tax

Inheritance tax is applicable to the estate of someone who has passed away. An estate typically includes money, property, and belongings (for example jewellery, artwork etc.).

For unmarried couples, the 40% inheritance tax applies on anything over the threshold of £325,000.

Protect your partner by preparing a will

When there is no will in place, unmarried couples do not automatically inherit each other’s estate when one of them passes away.

The house can be automatically inherited by the unmarried partner if they’re joint tenants. In this case, they would inherit the house through the right of survivorship.

This is why it’s extremely important to write a will if you want your unmarried partner to inherit your estate.

Married couples will automatically receive their partner’s entire estate even if there is no will in place through the rules of intestacy. If the person who passes away has children, the children will also automatically inherit part of the estate according to intestacy rules.

Typically, when a spouse inherits their partner’s estate as a gift, no inheritance tax applies which is one of the biggest financial benefits of marriage. This is known as spousal exemption. This only applies to UK-domiciled couples. If one spouse is based in the UK and the other is not, this exemption is limited.

Spouses can combine their inheritance tax, meaning when the second spouse passes away, the threshold on their estate is £650,000.

If a married couple owns a property, they can benefit from a further allowance which if unused can be transferred to the surviving spouse on death. This further tax relief can ringfence up to £1millon of the couple’s estate. This potentially saves the inheritor thousands of pounds in taxes!

Pension

A pension is a payment plan that supports you when you retire from working. This can be a state pension which is paid out by the government, a private pension, or a mixture of both.

Your pension is not considered as part of your estate when you pass away and so is not subject to any inheritance tax.

No one is automatically entitled to receive your pension when you pass away. It ultimately comes down to your pension provider and their terms. Many private pension providers will allow you to name beneficiaries for your pension, allowing those named to claim upon your passing.

State pensions stop as soon as you pass away, and no one can pass it down or inherit it.

Life insurance

Life insurance is a policy that ensures a lump sum payment upon your death. You can choose your own life insurance policy and add beneficiaries, which is who you’d like to give the money to.

Your life insurance can be subject to inheritance tax if the payout becomes part of your estate.

You can set up your policy as a trust, which means that you have nominated someone to distribute the funds when you pass away. By setting up your life insurance as a trust, it won’t count as part of your estate and therefore won’t be subject to inheritance tax.

Do the financial benefits of marriage still apply if my spouse isn’t a UK citizen?

The rules and financial benefits of marriage for international couples (known as mixed domiciled) differ from two married UK citizens. It can be much more complex to understand your financial rights when you or your spouse is not a UK citizen. This is where a financial advisor will be essential.

Potential change to couple’s rights – Cohabiting Rights Bill

It’s clear that married couples have better financial benefits and assurances than unmarried couples.

Cohabiting couples are increasing year on year, which has raised the question – should cohabiting couples have more protection under the law? It’s being presented to parliament that cohabiting couples should have the same rights as married couples when it comes to finances. However, some people are saying that this could reduce the flexibility of cohabiting and take away from the sentiment of marriage.

As the discussion develops, the laws remain the same. This means if you’re an unmarried couple, it’s important to protect one another with a will.

If you’d like to set up a will or trust, we’d love to help. We’re rated in the top 100 for wills and probate on ReviewSolicitors, so you can rest assured that we’ll provide you with a professional and quality service.

There are loopholes and nuances when it comes to taxes and finances, which is why it’s always best to consult with a financial advisor. They can provide you with regulated advice and ensure you and your partner are benefiting whilst also staying compliant.

Leave a comment Your email address will not be published.