Home > Family Law > Getting a Divorce > Divorce Financial Settlements: in for a Penny, in for a Pound

In this article

It’s reached that stage: the divorce financial settlement. Perhaps you’re dreading it, or maybe you’re more stoic and pragmatic about it all. This is the time when everything – including the kitchen sink – is laid bare for both you and your ex-partner to see, and where you agree on how it’s all split.

But how does it all work, and how do you agree on what’s fair? Financial settlements can be very long, so we’ve broken the process down into two parts: how it works and how you split what you have.

Looking to cut to the chase? Speak to our expert divorce team today by calling us on 0203 007 5500 or by submitting a contact form.

Part 3 in our ‘Getting a Divorce’ series

Part 2: Applying for Divorce

Part 4: Child Arrangements

What is a divorce financial settlement?

Divorce settlements set out what happens to all of a couple’s finances and properties after a divorce. They normally list out all the marital assets the couple has and dictate the terms on which they will be split and when they must be sold off.

What are marital assets?

Marital assets are the assets that you and your spouse have purchased or gained during the marriage. Marital assets can include any of the following:

- Properties

- Pensions

- Savings

- Cash in the bank

- Vehicles

- Furniture and appliances

- Stocks, bonds and mutual funds

- Businesses (even if one partner has no involvement in the business)

Furthermore, another marital asset that is commonly overlooked is debt. Any debts incurred during the marriage are split and paid off in the divorce financial settlement. Marital debts include mortgages, loans, overdrafts etc.

What about my assets gained before marriage?

Assets gained before marriage are considered non-marital assets. They are usually treated differently when it comes to a divorce settlement, but that doesn’t necessarily mean they’re off limits.

Are marital assets split 50/50 during a divorce?

It’s a common misconception that assets are automatically split 50/50. While most negotiations start at a 50/50 split, multiple factors can and will alter the division of marital assets in the divorce settlement.

Decisions should be made that suit the individual needs of each spouse and should consider their economic position, child care, and potential future earnings.

Do I need to go through a financial settlement if we made a pre-nuptial agreement?

Your pre-nuptial agreement is a persuasive document that will be considered during a divorce. The terms recorded within the agreement are likely to be granted unless there are circumstances within the marriage that override it. For example, if one person has drained assets due to reckless spending, or if someone needs to parent full-time, affecting their income.

Divorce financial settlements: how do they work?

Divorce financial settlements can be the bulkiest part of a divorce, both in terms of time spent and the emotional toll it takes. But the financial settlement isn’t inherently complex.

Instead, it tends to be your history together, the way you manage your affairs and how far both of you are willing to contest any agreement that complicates things.

Divorce financial settlements can go one of two ways: contested or uncontested. Normally, both sides will try to resolve things amicably, or uncontested, before going to court.

Uncontested or amicable divorce financial settlements

If you and your ex-partner maintain a good relationship, this is how you should begin discussions. Through informal discussions and drawing up proposals, it’s possible to agree on a split outside of court.

Even if you don’t get on with your ex-partner, it’s worth putting forward an agreement on neutral terms to gauge where they stand before going to court.

Doing this involves either:

- Putting forward your own offer; or

- Share a list of what you each own and try to agree on a split.

There isn’t one method that’s better, and many couples will try both approaches. Instead, it entirely depends on you and your partner’s relationship. If you can agree, you’ll need to instruct a solicitor to draw up a ‘financial remedy consent order’, sign it, and ask the court to agree on it.

Only one of you needs to instruct a solicitor to do this. The other person will normally find a separate solicitor to take ‘independent legal advice’ on the agreement. If that’s you, the solicitor providing this advice should give you their opinion on the agreement and whether it’s fair to you and/or your partner.

Independent legal advice: necessity or waste of money?

Independent legal advice isn’t mandatory. However, if you choose not to take advice, you may find out that the agreement highly favours your partner, and it will be extremely difficult to contest the divorce financial settlement.

In these situations, you’ll normally sign a waiver acknowledging that it was your choice not to take advice on the agreement. This is in part to stop you from saying that you never had the opportunity to do so and contesting the financial settlement later.

Due to everything above, I would always recommend taking legal advice from a solicitor on any consent orders.

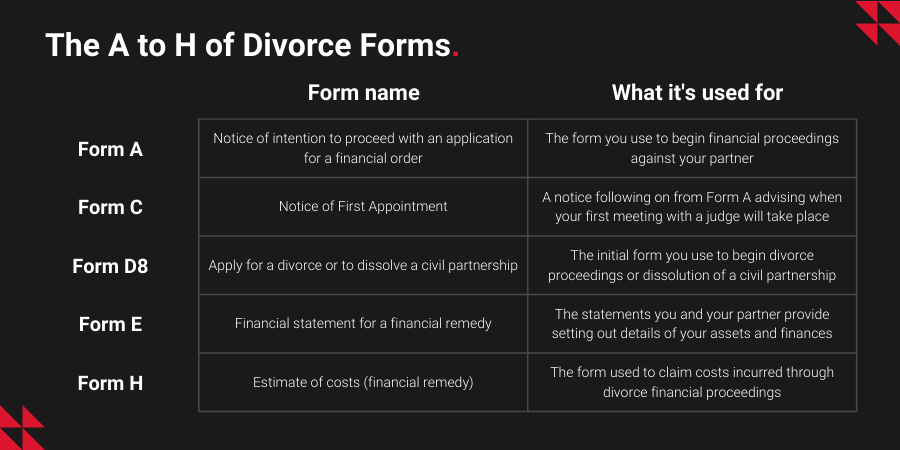

If you do decide to disclose your assets voluntarily, your solicitors may advise you to do this in the format of a ‘Form E’. While not strictly necessary, many solicitors do this in case you contest the proposed financial settlement. Your information is already in the format required by the court, saving both time and money.

Many couples try to agree on finances themselves to save the cost of going to court. But if you believe your partner may be hiding assets or you don’t anticipate they’ll agree, it may be better to go down the contested route.

Contested divorce financial settlements

If you can’t agree on a financial settlement with your partner, you have two alternatives: to mediate or to go to court.

Either way, you’ll need to attend a MIAM (mediation information and assessment meeting) with your partner. During this meeting, the mediator sets out your available options and assesses whether your dispute is suitable for mediation. This is a mandatory step before taking things to court.

Mediation

Many couples opt for mediation, but it doesn’t always work, nor is it suitable for every couple.

It involves a third party who tries to help you come to an agreement outside of the court process. The thinking behind mediation is that by introducing a neutral third party, some of the emotional and communication blocks are removed, allowing for a more fluid discussion and agreement. If mediation doesn’t work, the next step is court.

Mediation can take place at the same time as court proceedings, so it’s not an either/or scenario, however, you will incur costs from both processes. Due to this, many couples will investigate mediation first, followed by going to court if needed.

The Divorce Experts

Need help getting a divorce? Our expert team can:

- Guide you through the divorce from start to finish

- Outline the best way forward for you

- Handle contentious financial disputes

Divorce financial settlements: going to court.

Issuing court proceedings starts with Form A, which notifies the other party of your intent to begin the divorce financial settlement process.

You’ll then receive a Form C from the court, which tells you when your initial meeting or ‘First Directions Appointment’ will take place. This tends to be around 12 to 16 weeks after you file the Form A.

During this waiting period, you must prepare and file relevant documentation of the financial proceedings to the court, and provide your partner/ their legal representation with the same. It’s at this point that you would prepare your Form E (if you haven’t already done so) and exchange it with your partner.

Do you have to disclose everything in financial settlement proceedings?

Yes. When you and your partner submit your Form Es, you must also swear an oath or statement of truth. You may have heard about ‘full, frank and clear disclosure’ and that’s exactly what you must provide in your Form E.

If you or your partner actively try to hide money or assets, or forget to disclose items, deliberately or not, you can face severe action from the court. This can include having to pay for the other side’s legal costs, which can go far beyond any potential savings.

If you suspect your partner isn’t going to be honest about their financial position, your solicitor may advise running national and international financial searches to locate bank accounts and assets.

The first directions appointment

By this stage, you and your partner should have disclosed information about your finances to each other, your legal representation, and to the court.

You must attend the first directions appointment (FDA), which is held by a judge who may decide to take several actions, including:

- Giving directions to both parties, which simply means giving instructions to both sides.

- Adjourning or re-scheduling the first appointment to a later date if the judge needs more information

- Listing your case for a financial dispute resolution (FDR)

At any point in the court process and if you and your partner come to an agreement, you can submit a draft divorce financial settlement to the court, which may stop the remaining court process. The court then approves this draft, but this can only happen if a conditional order has been issued, and, in most cases, the order will only take effect once the final order has been issued.

Looking to start your divorce?

Ease the process and consult the experts now.

What are directions?

Directions cover a broad range of items, many of which aim to give the judge a clearer idea of the main disputed areas and assets. These directions can include providing:

- Evidence of your and your ex-partner’s mortgage-raising capacity

- Property particulars of potential new homes for you and your ex-partner

- Valuations of the family home

- A chronology or timeline of important events. This might include when you met, when you bought any properties, children’s birth dates

- Statements of issues about your specific disagreements

- An income schedule sometimes called an ES2. This is essentially a comparison table where you and your ex-partner list out all your assets, income and liabilities and where you believe any differences lay

- Business valuations, including shares, family business valuations, and business assets

- Anything else the judge deems to be missing from the FDA

Some couples, through the course of providing information under directions, will come to an agreement. If not, you’ll need to attend a Financial Dispute Resolution hearing.

Financial Dispute Resolution (FDR)

You’ll both attend an FDR hearing, where a judge will outline the items you can’t agree on and attempt to find a resolution.

If you have agreed upon a divorce financial settlement before the FDR, this can be presented to the judge, and they can approve it. If not, the judge will set a date for a final hearing.

Many divorces that reach this stage end here. This is because judges will provide a ‘judicial indication’ based on the evidence they have. This is essentially the judge telling you what their decision would be if they had to make one today.

Due to this, many couples opt to settle at this stage, unless they believe they have substantial new information that would affect the financial settlement.

The divorce experts

Unsure about getting a divorce? Don’t be. Contact us to arrange an appointment.

Lines open 24/7

020 3007 5500

The Final Hearing

If all else fails, the final hearing is where a judge will formally decide who gets what. Many divorce cases won’t reach this stage due to what the judge says at the FDR stage and because of the costs involved in funding legal representation.

A divorce financial settlement that goes to the final hearing typically costs from £20,000, ranging up to over £80,000 depending on how complex your affairs are.

Can I recover my divorce financial settlement legal costs?

Not normally. The family court is ‘cost neutral’, meaning each side bears their own legal costs. There are, however, some exceptions.

If, during disclosure, you hide financial information, forget to provide it (deliberately or otherwise), or try to move or hide money, you will likely face a penalty. These penalties can be severe and total thousands of pounds.

For example, if you try to hide bank accounts, pensions or shares and the judge finds out, they may order you to pay for a forensic accountant to uncover the extent of your hidden finances. In less severe cases, you may simply need to pay your ex-partner’s court application fees.

Drawing your divorce financial settlement to a close.

Once you have your divorce financial settlement agreed and signed, it’s almost time to draw things to a close. However, sometimes there can be one final hurdle: getting the other side to stick to the agreement.

While divorce financial settlements are legally binding, if a lump sum, sale of a property or any other action is required, the person needing to do so can refuse to do anything. If this happens, you may need to enforce the order by going back to court.

This is normally fairly straightforward, but it does add extra time and cost to proceedings. If this is the case, you may be able to recover some of your legal costs from your ex-partner if they deliberately try to slow things down.

Alternatively, if everything is in order, it may be time to celebrate a new chapter of your life. If you haven’t already done so, it may also be the right time to think about child arrangements.

0 Comments