In this article

Although cohabiting is on an upward trend, unmarried couples living together still have limited rights compared to married couples. This leaves almost a quarter of all couples in England and Wales legally uncovered and often unprepared.

If that’s you, you’re in the right place.

In this blog, we’ll be delving into cohabitation agreements. A great way to ensure you’re prepared for all eventualities in your relationship.

You can also find much more information about cohabiting in our cohabitation guide.

Want to cut to the chase? If you’re looking for a solicitor to help you with a cohabitation agreement, just call us on 020 3007 5500, or submit a contact form.

What is a cohabitation agreement?

Only 10% of unmarried couples have a cohabitation agreement and almost three quarters of all people have never heard of the term. A cohabitation agreement, also known as a living together agreement, is a legally binding document. It sets out assets and obligations within the relationship to cover couples upon separation.

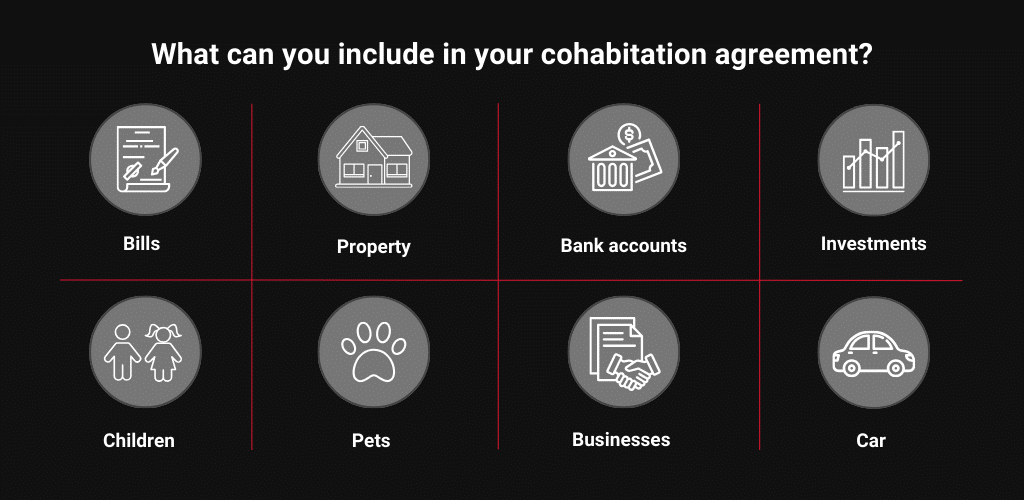

All relationships are unique, so a cohabitation agreement can contain a whole host of topics.

Generally, they’ll record a couple’s rights and responsibilities for:

- Their property (where they live or intend to live)

- Their finances (during and following the cohabitation)

- The arrangements made if they no longer wish to live together.

They can also include things like child arrangements, what will happen to pets and how to deal with joint debts.

Not a couple?

Usually, a cohabitation agreement applies to couples who want to live together with no intention of marriage. However, anyone sharing a property can apply for a cohabitation agreement. This applies to two or more people.

Talk to us now. Save costs further down the line.

Lines open 24/7

What’s the difference between a cohabitation agreement and a prenuptial agreement?

The purpose and content of cohabitation agreements and prenups are very similar.

The main difference is that prenups are specifically drafted for couples with the intention of getting married or entering a civil partnership.

What is the benefit of a cohabitation agreement?

Cohabitation agreements aren’t necessary for everyone, but they can be extremely helpful. Many people don’t truly appreciate the real cost of going to court and that’s exactly what could happen without a cohabitation agreement. Having your affairs in a legal document can avoid drama and further costs down the line.

If you don’t list all your assets and agree on your arrangements, you may have to deal with the dispute in court. Especially if there are items of high value in the relationship, such as a house or car.

They can also help you avoid disrupting the lives of pets and children, who could otherwise get caught up in disagreements.

Wondering if you’re covered by common law marriage?

Common Law Marriage dates back to medieval times and is no longer a legally recognised relationship type in England and Wales.

How can you justify a cohabitation agreement to your partner?

You may be nervous bringing up the idea of a cohabitation agreement to your partner in case you offend them or come across as unromantic.

In reality, the practical benefits outweigh the issue of romance.

But also, a cohabitation agreement helps to set expectations, avoid disputes, and keep you both prepared for the future. Your partner could take this as a sign of your care towards them.

What’s involved in the cohabitation agreement process?

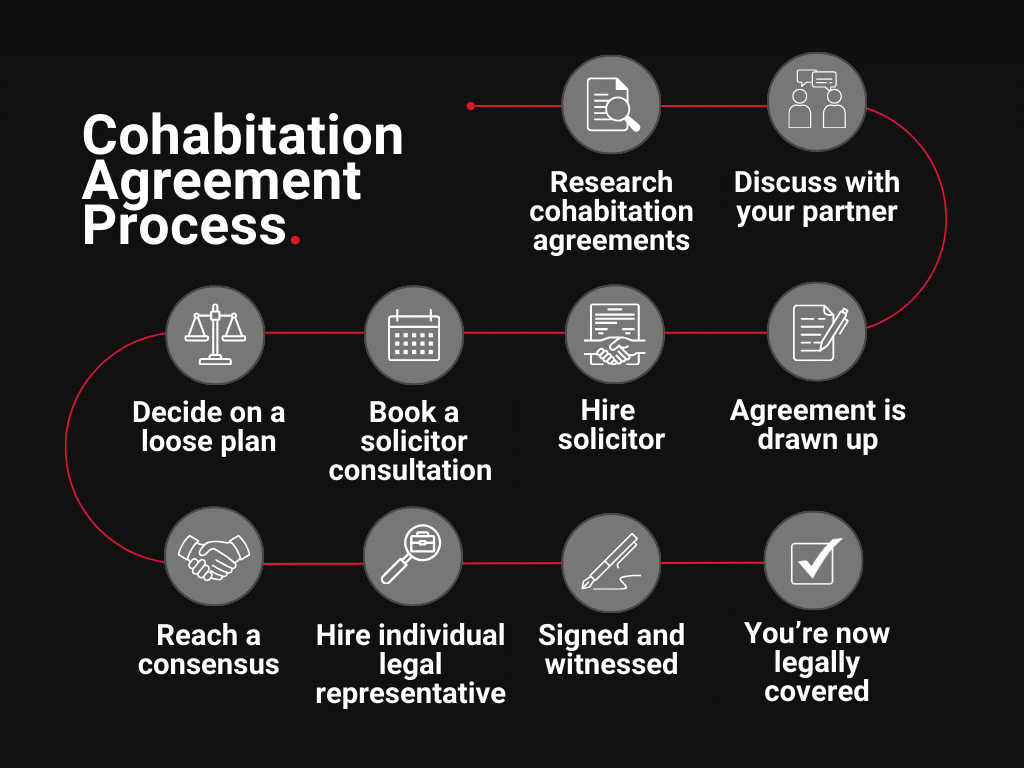

Before hiring a solicitor, you may want to discuss what you’d like to include in your agreement and try to decide what will happen to your house, assets, etc.

After that, you’ll need to book an initial meeting with a solicitor to discuss your requirements.

One of you will then hire the solicitor to draw up the agreement and send it to both you and your partner. The partner who hasn’t instructed the solicitor will need to find a second solicitor to provide independent legal advice on the agreement. This step is vital as it ensures your partner fully understands the contents and consequences of the agreement.

Once there’s a consensus on the content of the cohabitation agreement, you can both have your copy signed off and witnessed. Each partner needs to have an independent legal representative.

Are they legally binding?

A cohabitation agreement is only legally binding if:

- Drafted properly by a solicitor

- Executed in the required form

- All parties have taken independent legal advice

If your agreement meets these criteria, you’ll have full legal protection.

Having independent legal representation removes the possibility of duress. For example, if one side claims that the other ‘made them sign it.’ Solicitors can’t act for both sides here as it would be a conflict of interest.

Are you a cohabiting couple that needs legal advice?

Don’t worry, we’re here to give the advice you need when you need it. Just contact us to arrange an appointment.

Lines open 24/7

020 3007 5500

How much does a cohabitation agreement cost?

Due to the broad nature of relationships, the cost of a cohabitation arrangement can vary.

You’ll also need to factor in the cost of your partner’s solicitor. You’ll both need independent advice for the agreement to stand.

At Britton and Time Solicitors, prices start from £1,800 plus VAT, which increases depending on the complexity of your requirements.

For your partner’s legal advice, you should budget for around £300 plus VAT and above.

As your relationship evolves you may want to amend your cohabitation agreement. This will also come at an extra cost depending on the extent of the updates.

What if we can’t afford a cohabitation agreement?

There are other things you can do to ensure you and your partner have some protection, especially in the case of death. These include creating a will and naming your partner on your pension and life insurance.

How long are they valid?

The common rule is that you should review your cohabitation agreement every 5 years or whenever your circumstances change significantly. For the latter, this could be when you buy or sell a property, have a child, or receive an inheritance, amongst other things.

Bear in mind if you do not update or re-visit your cohabitation agreement regularly, it may become invalid or difficult to rely on.

There are also other exceptions. For example, if you have children after the sign-off and then separate, the court will make decisions based on the well-being of the child, regardless of what was set out in your cohabitation agreement.

Make sure to keep your cohabitation agreement up to date when there are major changes in your relationship.

Is a cohabitation agreement worth it?

When you think of everything in your relationship and your assets, what do you think they would amount to?

When trying to decide whether to get a cohabitation agreement, you should think about what you could lose if things end badly or if your partner passes away.

If you have high-value assets or own a property, it’s definitely worth covering those through a legal agreement.

The same applies to couples with pets or children, or for a couple with a serious illness. These matters can be complex and it’s best to set out a plan in advance to save time and money down the line. You could even avoid litigation or further legal fees.

With the rise in cohabitation across England and Wales, there could be a potential reform to offer couples living together more security. In the meantime, it’s important to implement your own securities to keep you and your partner covered.

How can Britton and Time Solicitors help?

Cohabitation agreements don’t have to be a stressful process. Our initial consultations with our family law solicitors offer you:

- Unlimited time to go through the details and ask any questions you may have

- An overview of your legal standpoint and your available options

- A precise time and fee estimate for your case

To arrange your initial consultation with one of our solicitors, simply call us on 020 3007 5500.

0 Comments